what kind of reforms contributed to an increase in the size of the federal government

Download FISCAL FACT No. 415: A Short History of Government Taxing and Spending in the United States

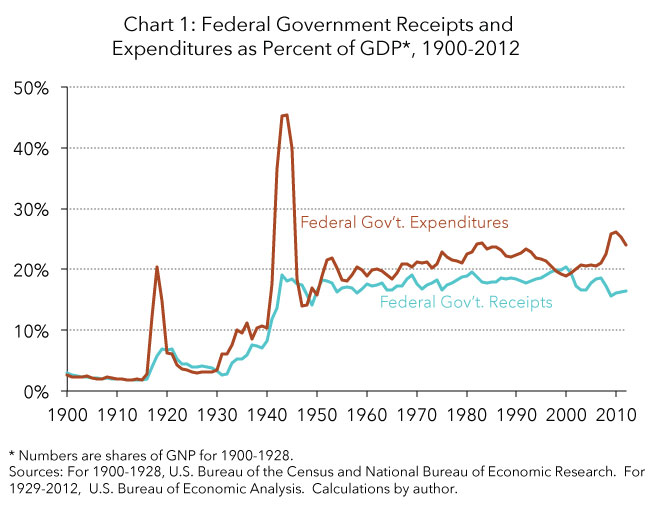

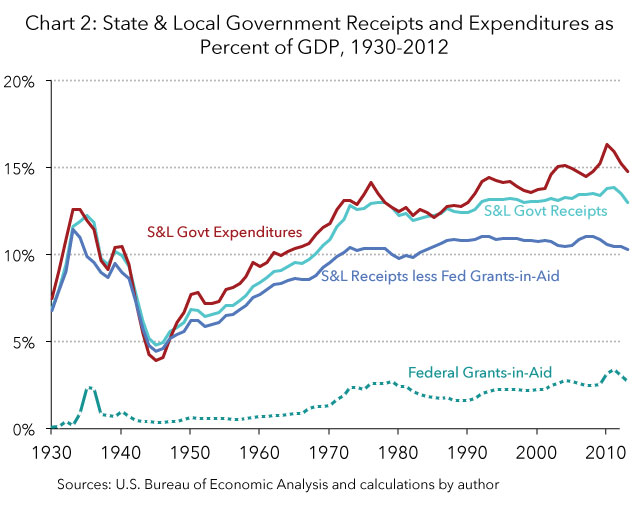

The federal government expanded dramatically in the 20th century and has continued growing in the 21st. Between 1900 and 2012, federal government receipts increased from 3.0 per centum of the economy'south output to 16.v pct, and federal expenditures rose from 2.7 percentage of economic output to 24.0 percent. State and local governments have as well expanded relative to the rest of the economy, although not about as much as the federal government. Between 1930 and 2012, land and local authorities receipts grew from viii.0 per centum to 13.0 percent of economical output, while their expenditures rose from 9.1 percent to xiv.8 percentage of output. For the overall government sector from 1930 to 2012, receipts increased from eleven.1 to 26.4 percent of gdp, (Gdp) and expenditures rose from 12.one to 35.6 percent of Gdp.

This Financial Fact provides an overview of these long-term trends.

The Data

The U.S. Bureau of Economic Analysis (BEA) supplies annual data going back to 1929 in the National Income and Products Accounts (NIPA) on the receipts and expenditures of the federal government,[1] of state and local governments,[2] and of the overall government sector.[3] BEA besides provides annual NIPA data beginning in 1929 on the U.S. economy'south gross domestic product (GDP).[4] These numbers were used to compute total revenues and expenditures relative to the size of the economic system for each year during the catamenia 1930-2012 for the federal authorities,[five] state and local governments, and the overall authorities sector.[6]

The federal government series were extended back to 1900 past drawing on 2 boosted sources. One is yearly data from the U.S. Department of the Treasury on federal receipts and expenditures for 1900-1929.[7] Another is a set up of estimates from the National Agency of Economic Research on U.S. gross national product (GNP) for each year in the menstruum 1900-1929.[eight]

The NIPA information does non precisely match the numbers in federal, state, and local budgets considering of various methodological differences between how BEA calculates the NIPA data and how state and local authorities compute their budget numbers. The advantage here of using the NIPA data for 1930-2012 is that information technology furnishes a long fourth dimension series of state and local regime information, and it reports the numbers for the various levels of regime on an internally consequent basis.

Every bit a related point, there is a break in the federal series between 1929 and 1930, because the earlier data exercise not come from NIPA. (The NIPA and non-NIPA information sets were compared for 1929, and their results are shut but not identical.) Still, the numbers on both sides of the break tell the same story: the federal regime was very small and then compared to today.

Looking at Government Receipts and Expenditures Relative to Economic Output is Useful just Doesn't Tell the Whole Story

Government receipts and expenditures are expressed here as shares of economical output, because the size of the economic system is an important determinant of the demand for government services and the ability to support those services. For example, taxes of $100 billion would be a crushing load in a $150 billion economic system but much less of a problem in a $600 billion economy.

However, it should exist noted up front that the size of government is only one of many factors that impact the burdens and benefits of government revenue and spending programs. For example, for a given amount of government revenue, the public will be meliorate off if the regime relies on taxes that are simple rather than complex (to lessen taxpayers' paperwork burdens), visible rather than hidden (to let citizens/voters accurately gauge the costs of authorities services), honestly administered (to uphold fairness and minimize corruption), neutral betwixt consumption and saving (for fairness and to promote growth), and structured to keep marginal taxation rates low (to reduce economical distortions that tiresome growth). Similarly, on the outlay side, the amount of government spending matters greatly but does not reveal, among other things, whether projects are managed efficiently or wastefully, whether programs generate benefits that exceed their straight and indirect costs, whether the authorities has prioritized high-value projects ahead of depression-value ones, and whether spending programs meet wide public needs or straight subsidies to political allies.

The numbers here also exercise not include well-nigh of the costs and benefits of government rules and regulations. Although at that place is much incertitude nigh their dollar amounts, the costs are certainly large and rising. For example, ane study estimated the regulatory costs imposed past the federal government were $1.8 trillion in 2013,[9] which would be well over one-half the size of, and in addition to, the federal taxes and other receipts reported in the NIPA information. For an indication of the growth of government rules and regulations, consider that the federal tax lawmaking has mushroomed from 400 pages in 1913 to 73,954 in early 2013.[10]

Federal Regime Expenditures Have Increased from under 3 Percentage of the Economy in 1900 to 24 Pct of the Economic system in 2012

Chart i shows the federal government's receipts and expenditures, expressed every bit percentages of economical output, from 1900 through 2012. Tabular array i provides snapshots at 10-year intervals.

The chart and table offer several takeaways regarding the long-term path of federal government revenue and spending.

- Until the 1930s, the federal government was extremely minor compared to the present. The federal government in one case concentrated on a few tasks, such as providing for the national defence, administering a relatively small set of federal laws, and operating a national post service.[xi] Although non shown on the chart or table, the federal government raised most of its coin from customs duties and excise taxes up until 1917.[12]

- Prior to the 1930s, the federal government during peacetime generally counterbalanced its upkeep or ran surpluses. From 1900 to 1916 (just before the country'south entry into Globe War I), federal receipts and expenditures both averaged 2.1 pct of economic output.

- The decade-long Corking Depression of the 1930s was a time of rapid growth for federal receipts and expenditures. Although not obvious because of Chart 1'south scale, both trends began in the last half of the Hoover assistants. On the spending side, the Hoover assistants initiated a number of public works and relief projects, and the Roosevelt administration doubled downward on that approach with a raft of New Deal programs. On the revenue side, the Hoover administration aggressively increased taxes (for example, hiking the height marginal individual income revenue enhancement rate from 25 percent to 63 percentage), and the Roosevelt assistants pushed through farther increases (for instance, raising the top marginal individual income tax charge per unit to 79 percent.)

- Federal spending and federal upkeep deficits typically soar during major wars. Federal expenditures climbed to twenty percent of national output during World War I—an approximately ten-fold increase from its pre-war level—and striking 45 percent of Gdp during World War 2. Although federal outlays quickly fell afterwards World War II (to virtually 14 percentage of Gdp), they jumped past more than half with the Korean War (to almost 22 percent of Gross domestic product). The failure of federal expenditures to drop sharply after the Korean War was probably due in large office to the prolonged Cold State of war. The federal government has historically enacted steep taxation increases during major wars, but most past wartime spending has been deficit financed.

- Federal receipts and expenditures have been permanently higher since World State of war 2 than they were before that war. For case, boilerplate federal expenditures during the period 1950 to 2006 exceeded the maximum level of spending at the acme of World War I.

| Table 1 Snapshots of Government Receipts And Expenditures In The United States, As Per centum Of Gdp, 1900 To 2012 | |||||||

| Twelvemonth | Gross domestic product* (in billions) | Fed Gov't. Receipts, as % of GDP* | Fed Gov't. Expend, equally % of Gross domestic product* | S&L Gov't. Receipts, every bit % of GDP | S&50 Gov't. Expend, as % of Gross domestic product | Total Gov't. Receipts, every bit % of Gdp | Total Gov't. Expend, equally % of GDP |

| 1900 | $nineteen | iii.0% | 2.7% | ||||

| 1910 | $35 | 2.0% | ii.0% | ||||

| 1920 | $91 | 6.7% | 6.2% | ||||

| 1930 | $92 | three.3% | 3.5% | 8.0% | 9.1% | 11.one% | 12.1% |

| 1940 | $103 | 8.3% | 10.4% | 9.3% | 9.four% | sixteen.6% | 18.four% |

| 1950 | $300 | 16.5% | 15.8% | 6.8% | 7.8% | 22.three% | 22.2% |

| 1960 | $543 | 17.v% | xix.0% | 8.vii% | 9.6% | 25.1% | 27.4% |

| 1970 | $1,076 | 17.5% | 21.2% | xi.vi% | 12.6% | 27.0% | 31.6% |

| 1980 | $2,863 | 18.nine% | 22.5% | 12.4% | 12.7% | 28.2% | 32.2% |

| 1990 | $5,980 | xviii.4% | 22.four% | 12.6% | xiii.5% | 28.9% | 33.8% |

| 2000 | $10,290 | twenty.3% | 18.8% | xiii.1% | thirteen.8% | 30.8% | xxx.0% |

| 2010 | $14,958 | 16.1% | 26.2% | thirteen.9% | 15.9% | 26.one% | 38.iii% |

| 2012 | $16,245 | 16.v% | 24.0% | thirteen.0% | 14.8% | 26.4% | 35.6% |

| * GNP, not Gdp, for 1900, 1910, and 1920. Note: Some expenditures and receipts, notably federal grants-in-aid, are counted in both the Federal and S&L series. The NIPA accounts net them out in the series for the Total Authorities sector. Sources: For 1900-1920, U.S. Bureau of the Census and National Bureau of Economic Inquiry. For 1930-2012, U.S. Bureau of Economical Assay. Calculations by author. |

- While much higher than before, federal regime receipts and expenditures stayed inside relatively narrow bands from the midpoint of the 20th century until just before the Dandy Recession. During the period 1950-2006, federal receipts averaged 17.9 per centum of GDP, and federal expenditures averaged 20.ix percentage of Gross domestic product.[xiii]

- After 1950, federal upkeep deficits became the dominion instead of the exception. Equally can be seen in Nautical chart one, Washington has habitually run deficits since 1950, except for a few years at the finish of the 20th century when the federal upkeep was briefly and barely in surplus.[14] Over the span 1950-2006, federal deficits averaged 3.0 percent of GDP. (Keynesian economics, which advocates government deficits in economically bad years, may be largely responsible for the weakening of budget discipline.)

- In the severe 2007-2009 recession and its aftermath, federal spending climbed higher than at any fourth dimension since World War 2, and federal revenue dropped to a level terminal seen in the belatedly 1940s. Federal expenditures peaked at 26.two percentage of Gross domestic product in 2010 (5.six pct points higher up the 2006 value) and federal receipts bottomed out at fifteen.6 percent of GDP in 2009 (two.9 percentage points below the 2006 value). In office, these movements reflect the sensitivity of federal spending and revenues to the wellness of the economy, combined with the recession's severity and the recovery'due south weakness. However, the increase in spending is greater than would have been expected based on economic factors lone. In 2011 and 2012, federal spending began falling, though it remained loftier, and federal revenue began ascension. Co-ordinate to NIPA information for 2013 (not shown on the chart), total federal spending was 23.3 pct of Gdp in the first three quarters of 2013, which is still 2.7 percentage points above its 1950-2006 average, while total federal acquirement was eighteen.ii per centum of GDP, exceeding its 1950-2006 average.[15]

To summarize this section, federal receipts and expenditures increased several times over relative to the rest of the economy in the first half of the 20th century. Their totals then stayed within moderately narrow ranges for almost the next sixty years. With the Corking Recession, spending burst out of its prior range, and the arrears rose to an unprecedented level for peacetime. Today, both spending and the deficit remain very loftier but are declining.

Until 1940, land and local regime were responsible for most authorities spending and collected most government revenues, except during major wars

Chart 2 depicts land and local governments' receipts and expenditures, expressed as percentages of Gross domestic product, from 1930 through 2012. Additionally, to discern the monies that state and local governments raise themselves, Chart 2 also shows country and local receipts net of federal grants-in-assist.

- The early years of the series concord a surprise, at least from the perspective of 2014. Land and local government revenues and outlays were one time significantly greater than those of the federal authorities. In 1930, country and local regime receipts were 8.0 percent of Gross domestic product to compared 3.3 percent at the federal level, and state and local authorities outlays were 9.one of GDP compared to three.v percent for the federal government. To show this visually, Nautical chart 3 straight compares state and local authorities receipts and expenditures with those that the federal level. (Land and local receipts in Chart 3 exclude federal grants-in-aid.)

- In the start one-half of the Great Depression, state and local receipts and expenditures increased relative to the overall economy, every bit shown on Chart 2. Even so, most of that reversed in the second half of the 1930s.

- The twelvemonth 1940 was notable because information technology was the last time country and local regime revenues and outlays were roughly on a par with those of the federal regime.

- State and local governments' share of the economy shrank during World War Ii, probably because so much of the nation's output was conscripted past the federal regime for the war effort.

- After Earth State of war II, land and local authorities revenues and outlays began a long climb. By 1975, state and local regime receipts were 12.ix percent of Gdp (3.vi percentage points college than in 1940) and expenditures were 14.i per centum of Gross domestic product (four.seven percentage points higher than in 1940).

- In the belatedly 1960s and early 1970s, during the Johnson and Nixon Administrations, federal grants-in-aid became a more important funding source for states and localities. This can be seen in Chart 2 by the rise in the line representing federal grants-in-assist and by the widening of the gap between state and local authorities receipts with and without that assistance. On the expenditures side, the outpouring of federal money has increased the federal government's influence and induced land and local governments to spend more than otherwise.

- Since 1975, state and local regime receipts have moved up and so down without a clear trend; they were 13.0 percent of GDP in 2012, which is essentially the aforementioned every bit in 1975. (If 1 excludes federal grants-in-assistance and looks at what states and localities collect themselves, receipts have been close to apartment since 1970.) State and local expenditures, however, accept been trending up, although much more slowly than before. Expenditures peaked in 2009 at xvi.4 percent of GDP, with some of that bankrolled by a large influx of federal stimulus spending, and were 14.8 percentage of Gdp in 2012 (0.7 percent bespeak college than in 1975.)

- Country government receipts and expenditures were once small compared with those of local governments. The NIPA statistics consolidate country and local government finances and do not show the levels individually. All the same, some Census Agency surveys report state and local regime finances separately. The Census data is used here to augment the NIPA statistics. In 1902, local government revenues and expenditures were approximately five times equally big as those of land governments.[sixteen] In 1932, the local-to-land ratio was approximately 3 to i.[17] In 1970, the local-to-land ratio was well-nigh one to 1.[18] The Census Bureau reports that local revenues and expenditures were slightly less than those of country governments in 1991-1992.[19] In 2011, the local-to-state ratio was approximately 0.8 to one.[twenty] These numbers actually understate the growing influence of country governments over local ones considering state transfers to local governments take risen from roughly 5 pct of local revenues in 1902 to roughly xxx percent in 2011.

In summary, between 1930 and today, land and local governments grew relative to the overall economy but non as rapidly as the federal government. In 1930, the state and local levels of government dominated in terms of receipts and expenditures, just now the federal level is ascendant. There has also been a shift from the local level of government to the state level.

From 1930 to 2012, Total Government Acquirement Grew from 11.1 Percent of GDP to 26.4 Pct of GDP and Total Government Spending Grew from 12.1 Percent of Gdp to 35.half dozen percent of GDP

Chart four presents the time paths of receipts and expenditures for all levels of government. The patterns are similar to those for the federal government except the totals are higher.[21]

Leaving aside the extraordinary spike in expenditures during World War II, the near noticeable fact is the growth of government. Over the period 1930-2012, authorities-sector receipts increased from xi.1 percentage of GDP to 26.iv percent, and authorities-sector expenditures rose from 12.1 percentage of Gdp to 35.half-dozen percentage, as measured past NIPA methodology. (See also Table ane.)

Government revenues and outlays have non continuously expanded, however. Government expenditures returned in the last one-half of the Clinton administration to approximately where they had been in the 1970s, and government revenues similarly returned in the early office of the Bush assistants to about their level in the 1970s. Since 2006, though, government outlays have jumped sharply, claiming over 38 pct of the nation'southward economic output in 2009 and 2010. The regime sector's deficits take likewise surged and were over 12 percent of U.S. economic output in 2009 and 2010.

Conclusion

When examining long-term trends, it is natural to wonder what the future holds. The NIPA data only displays past events. However, two considerations advise that federal taxes and spending, and to a lesser extent state and local taxes and spending, may exist poised to increase substantially.

One consideration is the Patient Protection and Affordable Intendance Act, more than widely called Obamacare, which is still in the process of being rolled out and which includes an array of major new federal taxes, fees, requirements, and government aid programs. Obamacare will as well put upward force per unit area on country government spending.

The other consideration is the aging of the population, which has huge budget implications on both the tax and spending sides, because the federal government has promised Social Security and Medicare benefits to seniors without setting aside whatsoever real avails to redeem those promises. The federal government also has not funded some of the benefits information technology promises to federal workers after they retire, and many states and localities have inadequately funded their workers' pensions.

If the regime sector expands farther, it volition go even more vital than information technology is already to trim unnecessary or low-return spending programs and to strive for simplicity, economic efficiency, and transparency in taxation policy to grow the economy.

[2] U.S. Bureau of Economical Analysis, National Income and Production Accounts, Tabular array 3.iii. Land and Local Government Current Receipts and Expenditures, http://bea.gov/iTable/index_nipa.cfm.

[5] To obtain the federal government's total expenditures, the author imputed two small-scale entries: capital transfer payments for 1929-1936 and net purchases of non-produced assets for 1929-1959.

[half dozen] The author imputed 2 small entries to obtain the overall regime sector's total expenditures: capital transfer payments for 1929-1936 and net purchases of not-produced assets for 1929-1959.

[eight] The American Business concern Cycle: Continuity and Change, Appendix B (Robert J. Gordon ed., Academy of Chicago Press 1986), http://www.nber.org/information/abc.

[12] Id. at Series Y 352-357, Federal Government Receipts-Authoritative Budget: 1789 to 1939; Series Y 358-373, Internal Revenue Collections: 1863 to 1970.

[xiii] Although the expenditures total did not change much, there were some huge compositional shifts, notably a major increase in federal transfer payments and other "entitlements" and a reject in federal defense spending.

[14] As a reminder, the receipts, expenditures, and deficits reported here are based on NIPA methodology, which differs from the numbers that appear in the federal budget. According to the federal budget, the regime also posted surpluses in 1951, 1956, 1957, 1960, and 1969. Encounter Office of Management and Budget, Historical Tables, Budget of the U.S. Government, FY 2014, Table 1.2—Summary of Receipts, Outlays, and Surpluses or Deficits (–) as Percentages of Gross domestic product: 1930–2018, http://www.whitehouse.gov/sites/default/files/omb/budget/fy2014/assets/hist.pdf. Even so, even if one looks simply at the official federal budget, it is still evident that deficits take become the norm and surpluses the exception.

[xv] The rebound in receipts is due to both the recovery and the tax increases enacted as role of the "fiscal cliff" bargain at the beginning of 2013.

[16] See U.S. Census Bureau, Historical Statistics of the Us: Colonial Times to 1970, Series Y 710-735, Country Authorities Revenue, by Source: 1902 to 1970; Series Y 736-782, Land Government Expenditure, past Graphic symbol and Object, by Function, and Country Government Debt: 1902 to 1970; Series Y 796-816, Local Authorities Acquirement, by Source: 1902 to 1970; and, Series Y 817-848, Local Government Expenditure, by Part: 1902 to 1970.

[21] Total government receipts practise not equal those of the federal government plus those of state and local governments, considering BEA nets out inter-governmental transfers when computing the NIPA data for the overall government sector. The aforementioned is true on the expenditures side.

Source: https://taxfoundation.org/short-history-government-taxing-and-spending-united-states

0 Response to "what kind of reforms contributed to an increase in the size of the federal government"

Post a Comment